By NIGEL JAQUISS/Oregon Journalism Project

Last week, the Legislature’s Joint Committee on Transportation released its long-awaited funding proposal for the Oregon Department of Transportation.

The proposal, which would raise nearly $1 billion a year, includes a slew of ideas, such as higher title and registration fees, a sales tax on vehicles, a road-use charge on delivery vehicles, and gradually moving all electric vehicles into a pay-per-mile program. It also features a 20-cent-per-gallon gas tax increase, phased in over six years. That would increase the gas tax from 40 cents per gallon to 60 cents, a 50% increase. California’s current tax is 68 cents; Washington’s is 53 cents.

The proposal, which would raise nearly $1 billion a year, includes a slew of ideas, such as higher title and registration fees, a sales tax on vehicles, a road-use charge on delivery vehicles, and gradually moving all electric vehicles into a pay-per-mile program. It also features a 20-cent-per-gallon gas tax increase, phased in over six years. That would increase the gas tax from 40 cents per gallon to 60 cents, a 50% increase. California’s current tax is 68 cents; Washington’s is 53 cents.

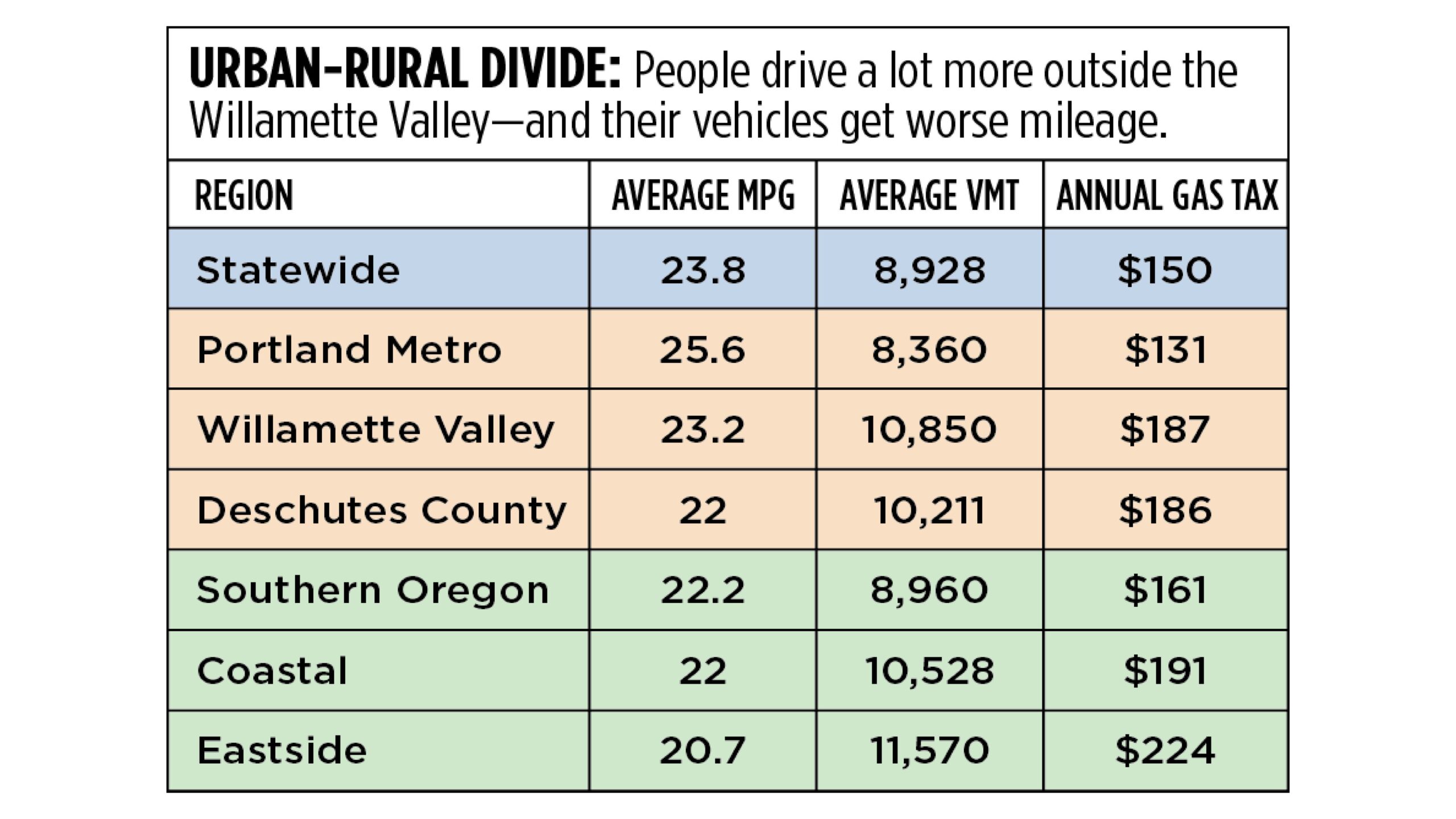

A November report ODOT produced in preparation for the funding package, however, shows that the gas tax does not fall equally on all Oregonians. Drivers in rural Oregon, the agency’s data shows, drive far more miles than urban Oregonians and do so in vehicles that travel fewer miles per gallon of gas.

“Rural residents drive farther to get to work, school or shopping,” says Rep. David Gomberg, D-Otis, whose district includes the central Oregon coast and Coast Range. “And we drive less fuel-efficient vehicles. Because the fact is that there are more pickup trucks in Otis than there are in the Pearl District.”

Indeed, ODOT’s numbers show that rural Oregonians pay more in gas taxes than urbanites, with the biggest difference between those living east of the Cascades, who pay 71% more than people in the Portland metro area.

Oregon built its gas tax system on a “user pays” principle, although as the Oregon Journalism Project has reported, the Legislature has failed its constitutional duty to equalize payments from passenger vehicle owners, who have underpaid in recent years, and heavy-truck owners, who have overpaid.

But the formula by which the Legislature distributes gas tax dollars penalizes rural Oregonians. ODOT gets half the proceeds; 30% gets distributed to Oregon’s 36 counties, based on the number of vehicles registered; and 20% goes to cities, based on population.

“This system ignores that rural drivers pay more in gas taxes yet receive less in return for road funding,” Crook County commissioner Seth Crawford says. “It’s frustrating.”

The state’s most populous counties, which include its largest cities, get the lion’s share of the money the state distributes, even though their residents drive relatively less. There are offsetting examples in other areas; income taxes from the Willamette Valley, for instance, subsidize rural residents.

Gomberg says this legislative session is an opportunity for the Transportation Committee, which also says it hopes to equalize the payment balance between light and heavy vehicles this year, to fix the urban-rural imbalance.

“As long as we’ve had the gas tax, we’ve had this problem,” Gomberg says.

Transportation Committee co-chair Rep. Susan McLain, D-Hillsboro, notes that while rural motorists pay more in taxes, they also benefit more from ODOT plowing and maintenance work. But she and co-chair Sen. Chris Gorsek, D-Gresham, pledge to make the system more equitable.

“As part of the ongoing conversations around this package, relief for low-income drivers (especially in rural communities) will be a North Star that we take very seriously,” Gorsek says.

- Nigel Jaquiss is a reporter for the Oregonian Journalism Project and can be reached at njaquiss@oregonjournalismproject.org. OJP is a nonprofit news initiative whose goal is to inform, engage, and empower Oregonians with data-driven and solution-seeking investigative reporting that makes a significant impact at the state and local levels — serving no agenda other than a pursuit of the truth.

Rural citizens also have less access to mass transit alternatives to private vehicle use. And we’re often lower income than urban areas with higher income employment opportunities.

About time someone pointed out the inequity. Rural communities have fewer amenities which means having to drive long distances for health services and shopping in particular. For example, Newport residents often have to drive to Corvallis for medical treatment unavailable on the coast. Portlanders have multiple options for specialists, hospitals, etc., within the city. Rural residents are penalized for having to go longer distances than urban dwellers to get what they need. Highway 101 between Newport and Depot Bay is in deplorable condition. Three areas in particular are subject to collapse. 101 is the north/south lifeline for people on the coast. Don’t they deserve roads as well maintained as those in major arteries in the rest of the state? Especially, since rural drivers pay higher gas taxes than others but don’t get equal bang for their bucks. The Legislature needs to make changes to benefit those who are paying more than their fair share.

I’m sure Oregonians pay enough taxes in the present gas tax structure to pay for road upkeep and bridges. It is all the other things the state uses the gas tax for thee cuts that short. Like all the bicycle bridges, paths, etc.

It may still seem surprising, but back in 2015, before e-car proliferation, a study came out proving America’s various gas taxes (OR’s is pretty low) are not enough. We’ve been seeing the Oregon Legislature (including GOP Sen. Anderson in his Hwy 20 bill) reach into the general fund for road expansion. Even people who don’t own cars or can’t drive pay income taxes into the general fund. Here’s the study for anyone interested, which also says of transportation cycling, “Most walking and bicycling takes place on local streets and roads that are primarily paid for through property taxes and other general local taxes”: https://frontiergroup.org/resources/who-pays-roads/. Many recreational bikers seen on state highways also own cars and pay gas taxes.

Meanwhile, the 1971 Oregon bike bill, which was created by Republican Rep Don Stathos (Jackson County) and signed into law by Republican Governor Tom McCall (the party doesn’t matter but people like Rep-Dem banter and some make weird assumptions about who cycles) set into law that all local jurisdictions must spend 1 percent of the state highway fund they receive on bicycle and walking infrastructure.

But–is that law actually being followed? Accounting-wise, have Lincoln County and its cities been spending that 1 percent at least to facilitate bicycle travel, bike parking, and walking? For example, Lincoln City doesn’t require bike parking at new retail places like their new O’Reilly’s, but also doesn’t seem to build any bike parking or paint new sharrows or whatnot. Newport & other cities have at least been adding sidewalks.

City of Newport doesn’t repaint or otherwise maintain its sharrows and how many bike lanes or sidewalks has it created in the past 10 years? Two blocks of NW Biggs will be pavied this year–no sidewalks planned, even though NW Biggs goes past/to a neighborhood park.