By QUINTON SMITH/Lincoln Chronicle

Property owners in four fire districts across Lincoln County and in the city of Toledo will see a bump in their taxes this fall after voters there approved new levies for services in May.

But if you own property or live outside of those districts, your property taxes will go up 3 percent – which is normal — when the notices from Lincoln County begin arriving in the mail this week.

Voters in four fire districts – East Lincoln, Depoe Bay, Seal Rock and Central Coast in Waldport – approved new levies to support services and their taxes will go up as a result. Toledo voters approved a bond for a new water reservoir.

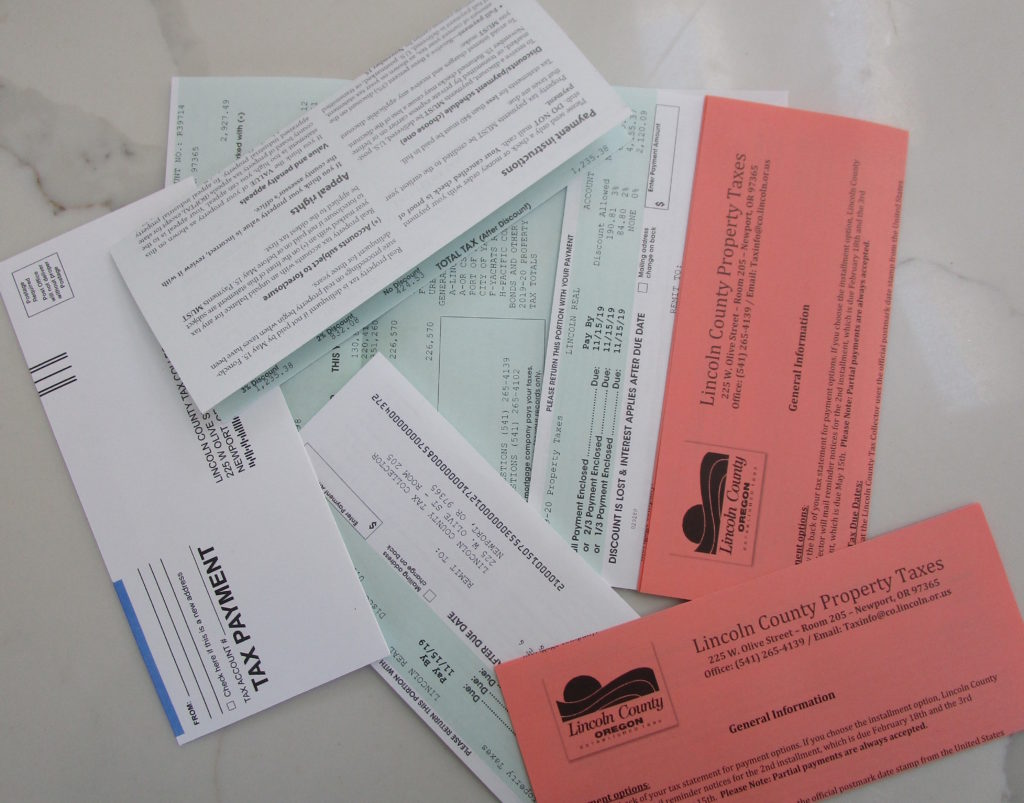

Property tax statements are scheduled to go in the mail Monday to 47,205 accounts. More than 10,000 of those bills go to banks or mortgage companies, which pay the taxes for people with loans.

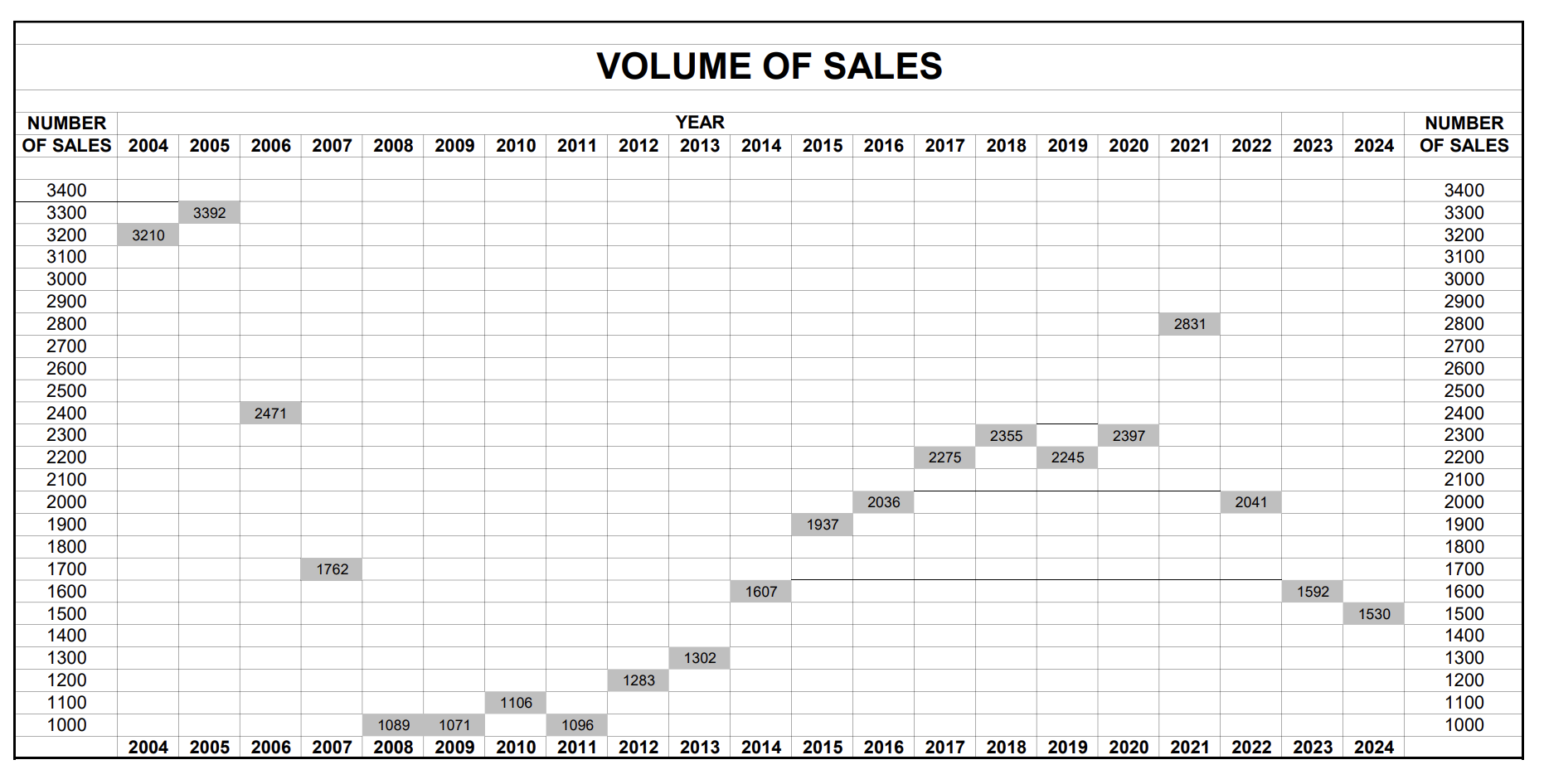

The most noticeable trend this year, says county assessor Joe Davidson, is the leveling off in property values and the slowdown in the number of real estate sales.

The assessment date for property taxes is Jan. 1 of each year. Overall, real market value of all property in the county increased 0.8 percent from Jan. 1, 2024 to Jan. 1, 2025, Davidson said. That compares to a record increase of 24 percent in 2022, 16 percent in 2023 and four percent in 2024.

Davidson attributes the flattening of property values to stubbornly high interest rates that hampers sales, inflation and overall economic uncertainty.

“As we start to flatten out or decrease, that always generates questions as to why,” he said.

Yachats real estate values increased 3 percent in 2024, Davidson said, while Waldport’s dropped 2 percent. Oceanfront property in Newport increased 9 percent in value, he said, while Siletz River waterfront properties climbed 11 percent.

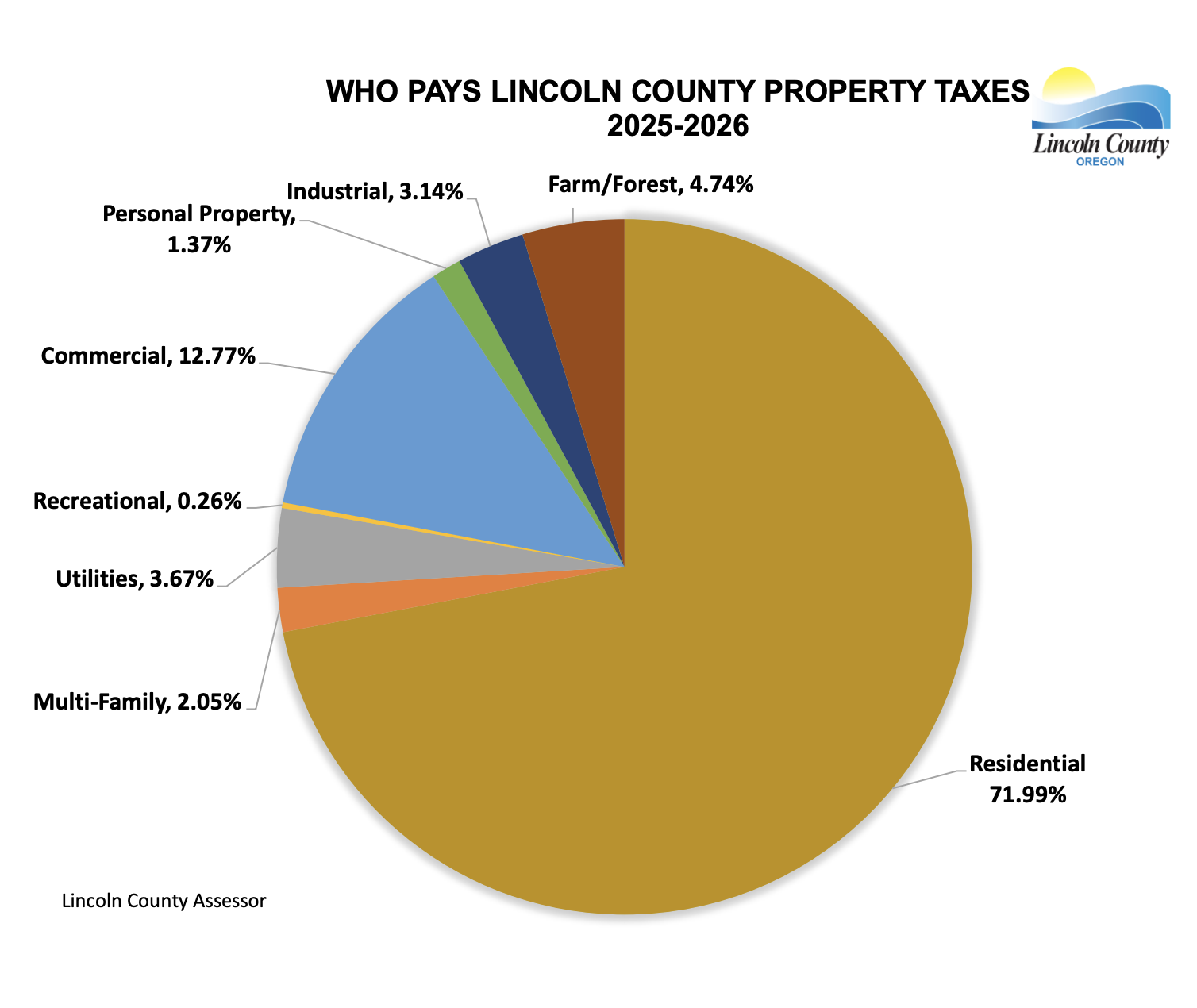

But property taxes are based on assessed valued – not real market valued, Davidson said, and countywide this year, assessed value is 54 percent of real market value.

Sales of single-family homes in Lincoln County for the first nine months of 2025 totaled 1,045, Davidson said. That compares with 1,187 for the same period of 2024. In 2022, that number was 1,675.

Depends where you live

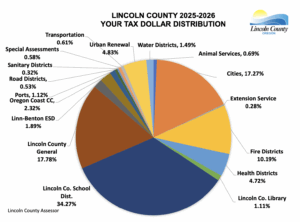

There are 85 taxing districts in Lincoln County, including countywide school and community college districts, health districts, city, county, port, fire protection, water, road, special assessment districts and urban renewal districts. All of them have distinct and different tax rates and most have different geographic boundaries, so overall tax rates for individual properties vary by location.

Each property tax statement displays total amounts imposed by individual taxing districts, along with current and prior year property values. Values for both years are categorized by land, structure, total real market value and total assessed value.

Generally, property taxes are a product of assessed value and underlying taxing district rates, Davidson said, and like changes in assessed values, changes in tax rates can impact overall property taxes.

These are the notable taxing district rate changes this year:

- East Lincoln County Fire & Rescue District: New 5-year local option levy for operations with a rate of 39 cents per $1,000 assessed property value;

- Seal Rock Rural Fire Protection District: New 5-year local option levy for operations with a rate of 25 cents per $1,000 assessed property value;

- Central Oregon Coast Fire & Rescue District: 5-year local option levy renewal for operations with a rate of $1.87 that replaces a previous levy rate of $1.27, resulting in a net rate increase of 60 cents per $1,000 assessed property value;

- Depoe Bay Rural Fire Protection District: 5-year local option levy renewal for operations with a rate of $1.39 that replaces a previous levy rate of $1.09, resulting in a net rate increase of 30 cents per $1,000 assessed value;

- City of Toledo: General obligation bond for Ammon water reservoir replacement that replaces a previous bond that matured prior to 2024, resulting in a rate increase for 2025 of approximately 44 cents per $1,000 assessed property value; and

- Oregon Coast Community College: General obligation bond for new trades education center that replaces an expiring bond with similar tax rate.

Davidson said county property appraisers visited all properties in the city of Yachats this year, parts of the Bayshore community north of Newport, Idaho Point in South Beach and Olivia Beach in Lincoln City. They are now visiting physically appraising more than 700 properties in the San Marine area north of Yachats.

In 2026, Davidson said appraisers will be visiting restaurants throughout the county.

Davidson said his department’s goal is to get all physical appraisals, including commercial, on a 10-year cycle. Some properties haven’t been appraised in 20 years, he said.

Making a payment

Initial property tax payments are due by Nov. 17. Full payments made by then receive a 3 percent discount and two-thirds payments receive a 2 percent discount. For property owners making one-third payments, the second payment is due by Feb. 17 and the third payment is due by May 15.

Payments can be made electronically online, mailed with a postmark on or before Nov. 15, dropped off at a collection box in the county courthouse parking lot, or in person at the tax office located in Room 205 of the courthouse.

Davidson said property owners disputing their values are encouraged to contact the assessor’s office. Appraisal staff will be available to answer questions and review properties for possible adjustments until Dec. 31. Taxpayers also have the option to file value petitions with a special citizen appeals board until the end of the year.

“We encourage people to call us if they have questions,” he said. The phone number is 541-265-4102.

The county assessor’s and tax collector’s offices are open from 8:30 a.m. to 5 p.m. Monday through Friday. Davidson said most value and tax-related questions can be answered by phone or email and that all assessors will be in the office next week to help answer questions.

Visit the assessor’s webpage for more information about property tax payments: