By MIKE FRANCIS/The Lund Report

Samaritan Health Services, the dominant healthcare provider in Lincoln, Benton and Linn counties, will jump into the arms of the much larger MultiCare Health System of Tacoma, the two nonprofit organizations announced Wednesday.

The deal comes even though a consultant advised Samaritan this summer it could survive as an independent organization.

The two health care systems said they expect the deal to be completed in spring or summer next year. While they call the deal “an affiliation,” Samaritan will become a part of MultiCare.

Samaritan is a nonprofit health system covering Lincoln, Benton and Linn counties with more than 5,000 employees, including 620 clinicians. In Lincoln County, Samaritan employs 841 people, has standalone hospitals in Newport and Lincoln City and eight clinic locations in Newport, Lincoln City, Depoe Bay, Waldport and Toledo.

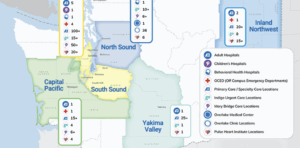

Nonprofit MultiCare Health operates 13 hospitals in Washington, mostly in the Puget Sound region, and more than 300 clinics and urgent care locations. It also has hospitals in Spokane and Puyallup.

It is MultiCare’s first purchase of a health system in Oregon.

The proposed deal, which has to be approved by Oregon regulators, would make it just the latest independent hospital or health system in the state to affiliate or be absorbed by a larger partner, reflecting a nationwide trend that has sparked concerns about its effect on access to care.

In Samaritan’s public statement, president and chief executive officer Marty Cahill said the deal is “an important step in securing the future of nonprofit health care in our region.” In an email, a company spokesperson said the transaction “positions Samaritan to move from stability to long-term strength.”

A Samaritan web page set up to answer questions about the MultiCare deal said it will not cause immediate changes for patients, who will continue to see their current providers and continue to be able to access their patient portal.

When the deal is completed, Samaritan said it will continue to operate under its own name “with MultiCare’s logo added as the supporting logo.”

MultiCare, which traces its roots to the establishment of Tacoma’s first hospital in 1882, has expanded through the decades into eastern Washington and what it calls the Capital Pacific region from Olympia to the coast. Last October, it completed a deal to affiliate with Bellevue-based Overlake Medical Center and Clinics. MultiCare’s most recent financial report said “no consideration was exchanged” in the deal.

MultiCare lost almost $39 million on an operating basis for the first six months of the year, but more than made up for it with gains from investments, with a bottom-line excess of revenues of almost $108 million. The results did not include Overlake’s financial performance.

Samaritan faced pressures

Hospital systems face an array of rising costs, from salaries to equipment and IT systems.

In Oregon, they must also cope with state regulations regarding charity care, cost-growth and nurse staffing that were adopted in recent years. At the same time, health care officials say reimbursements by government – Medicare and Medicaid — and commercial insurers are falling behind their expenses. It’s particularly difficult for small hospital systems to keep up.

Samaritan Health’s consolidated entities spent more than $13.2 million more than they took in for the first half of the year, according to the organization’s most recent financial report. They reported revenues of $911 million.

In March, Samaritan filed a notice of an expected technical bond default, sparking rumors that it was on the block. In an interview with The Lund Report, then-chief executive officer Doug Boysen acknowledged the financial pressures on Samaritan and other Oregon hospital systems, and said “we are looking at all different potential options to make sure that Samaritan is sustainable into the future.”

He called Oregon’s current health care environment “unsustainable.”

To address the default notice, Samaritan hired Warbird Consultants to take a look at its finances. In late April, the firm made a variety of recommendations to increase Samaritan’s income and cut its expenses. If it did so effectively, the consultant concluded, “Warbird believes that Samaritan does not need to affiliate with another party for long-term survival.”

On its acquisition website, Samaritan said it “evaluated several potential partners” and MultiCare was “the strongest match.”

State expected to review

The health care merger trend nationwide has sparked concerns that it can hurt access to care.

Lawmakers set up Oregon’s Health Care Market Oversight program to conduct reviews of mergers, acquisitions and affiliations. It looks at potential effects on care and working conditions before deciding whether to recommend approval.

Samaritan and MultiCare will seek approval from regulators “in the next few weeks,” a company spokeswoman said by email Thursday.

A statement from the Oregon Nurses Association after the proposed deal went public Wednesday urged state and federal regulators to take “a hard look” at Samaritan’s plan to affiliate with MultiCare. The association, which represents Oregon 24,000 nurses and other healthcare workers, said regulators must ensure that the deal won’t result in higher costs, or in cuts to services or employment.

Samaritan officials did not directly respond to a question about the affiliation’s effect on employment, but they noted it would create “new opportunities for growth as we expand services, modernize facilities and strengthen access to care.”

“Our goal is not to cut, but to grow: to grow services, opportunities for our workforce and the long-term stability of community-based care across the mid-Willamette Valley and central Oregon coast,” a Samaritan spokeswoman said via email.

MultiCare will invest an unspecified but “significant” amount of money in Samaritan Health over the next 10 years, according to the spokeswoman’s email. She said the money will be used to strengthen “critical infrastructure and modernization needs at Good Samaritan Regional Medical Center in Corvallis, expanding outpatient and specialty services across the region, and recruiting and retaining physicians and other caregivers.”

Samaritan said the sale will also bring MultiCare’s behavioral health network – the largest in Washington – into Samaritan’s service area, “increasing access to the mid-Willamette Valley and central coast.”

The MultiCare deal would also include Samaritan’s InterCommuity Health Plan, one of 15 managed care entities known as coordinated care organizations that the state contracts with to provide care under the Medicaid-funded Oregon Health Plan, which serves people with low incomes. InterCommunity has an enrollment of about 87,000 in Samaritan’s three-county service area.

- Mike Francis is an editor at large for The Lund Report and can be reached at mike@thelundreport.org. The Lund Report is an independent, nonpartisan, nonprofit, online news source covering health care issues in Oregon and southwest Washington and a news partner of Lincoln Chronicle.