By DANA TIMS/Lincoln Chronicle

The rush hasn’t started yet, but William Tanner expects it will soon.

“I thought I’d be swamped with calls by now,” said Tanner, an independent insurance agent who suddenly finds himself representing the only company that in 2026 will still be offering Lincoln County seniors a popular Medicare Advantage plan. “But within a few weeks, I can tell you, a lot of folks will realize they need to get moving.”

His comments come in the wake of Samaritan Health Plans’ announcement in early October that it will no longer offer a plan currently relied upon by fully one-tenth of the county’s aging population.

Of Samaritan’s 13,881 Medicare Advantage members in Lincoln, Benton and Linn counties, nearly 5,000 are in Lincoln County.

The development is just one of many that currently are roiling all levels of health insurance coverage across the country.

UnitedHealthcare, for instance, the nation’s largest Medicare Advantage insurer, recently announced it will end certain plans affecting coverage for about 600,000 members across the U.S. Humana, another major insurer of seniors, said it expects to lose more than half a million members, while health-insurance giant Aetna is closing nearly 100 plans across 34 states.

“That amounts to an awful lot of chaos for a whole bunch of people,” Tanner told Lincoln Chronicle. “No one knows exactly what’s going to happen next.”

Cause and effect

Making sense of this rapidly changing insurance landscape boils down to grasping the causes and effects involved, insurance experts say.

First, are the causes, which come down to the simplest of market basics.

“It’s not sustainable,” Dr. Lesley Ogden, the chief executive officer for Samaritan Health Services’ two hospitals in Lincoln County, told a Newport Chamber of Commerce luncheon last week. “We can’t do this.”

Unlike national or larger insurance programs, Ogden said, smaller insurance operations like Samaritan did not have a large enough base of healthier policy holders to offset use by sicker ones.

“Unfortunately, because we are sicker in Lincoln County, there’s now only one Advantage plan available,” she said.

Medicare Advantage plans are listed and sold by zip code. Type in the zip code for Philomath, for instance, and 33 possible plans, with all costs and benefits listed, pop up. Enter the zip code for Portland, and the number of plans soars to 44. Type in Newport’s, by contrast, and one lone offering from Devoted Health appears.

Diane Faligowski, chief executive officer of Health Plans in Oregon, said Lincoln County’s older and relatively poorer population explains the dearth of advantage plans. As a way to explain that lack, she provided an example of what Samaritan Health’s Ogden called a lack of sustainability.

Faligowski, whose company helps seniors navigate insurance options, described a situation where a single plan has 1,000 members. In her scenario, almost all members are relatively healthy, pay in their premiums, and end up using few resources.

One member, however, requires dialysis treatments for ailing kidneys.

“That member alone ends up using almost all of the premiums,” she said. “Even one or two people with expensive health care costs takes off the profits or they even go negative. And that’s precisely why it’s hard for any carrier to stay in any rural areas.”

The effect of this dynamic, represented locally by Samaritan’s decision to leave the Medicare Advantage market, leaves thousands of seniors now scrambling to find alternatives.

Plenty of time to plan

But despite seemingly short timeframes, which create pressures all their own, there is still ample time to find suitable alternatives, experts say.

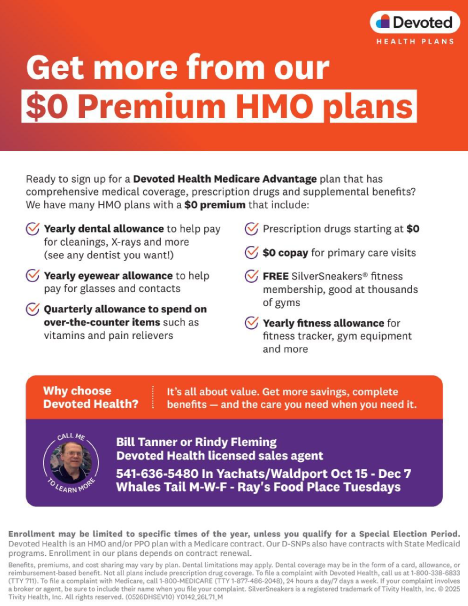

The lone remaining company, Devoted Health, will continue selling Medicare Advantage plans to Lincoln County residents in 2026. Tanner and just a few other agents have the certifications they need to field possible applicants.

Devoted Health, founded by two brothers in 2017 along the East Coast, is offering a tier of policies, which the lowest premium starting a zero dollars per month, Tanner said. Policy options include co-pays of $35 per visit to see specialists and a $1,500 payment for dental services.

“These are good policies with a good number of options,” he said. “For anyone still wanting a Medical Advantage plan, these are very, very solid.”

For the first time, Devoted Health is also entering Tillamook County as a new Medical Advantage plan provider, said Charlotte Lehto, a Farmers Insurance agent in Lincoln City. It marks the first time that Tillamook County has said an advantage plan offering since 2023, when MODA Health ended its contract with Medicare, she said.

Lincoln County residents losing their Samaritan plans now have a “special enrollment period” that provides additional time to figure out next steps, Lehto said wrote in an email.

“This timeframe is outside the regular medical annual election period which begins Oct. 15 and ends Dec. 7,” she added. “This is important because Samaritan members may be panicked, thinking they must have a new enrollment completed by Dec. 7, which is not the case.”

A few extra weeks

The designation of a “special enrollment period” is also important because it means that if a member wishes to return to original Medicare and purchase a Medicare Supplement plan, they will not have to answer any questions regarding their medical history, Lehto wrote.

“Without a special enrollment period, a Medicare beneficiary is required to answer questions on an application regarding their medical history (this is called medical underwriting) and may be declined by the carrier for coverage,” Lehto said.

She noted that Medical Supplement plans – also known as Medigap plans – do not include prescription drug benefits. Those plans can be purchased separately. She also stressed that supplement plans do not include routine dental, vision and most alternative care benefits or extra benefits, such as over the counter or food cards.

On a final note, Lehto said it is hard to overstate the turbulence that Samaritan’s exit from the Lincoln County market has caused.

“The Medicare system itself is complex, difficult to understand and navigate for most people,” she wrote. “When you add to that the departure of a well-known plan with very rich medical benefits and ancillary benefits, we have seen confusion, disappointment and fear.”

Lehto and other insurance experts underscored the importance that industry resources can provide.

Four upcoming events, for instance, all scheduled at the Lincoln County Cultural Center, will review options under Medicare and present the benefits of the Devoted Health plans. The events, from 10 a.m. to noon, will be held Oct. 12, Nov. 18, Dec. 16 and Jan. 20. An additional event will be held 6-8 p.m. Nov. 4 at the Gleneden Beach Community Center.

In addition to the multitude of independent insurance agents available in the area, another resource people might find useful is the Senior Health Insurance Benefits Assistance program, a state effort that offers free health insurance counseling to people with Medicare and their families.

SHIBA relies on trained community volunteers to help the public understand the rapidly changing landscape of Medicare and Medicaid. To that end, the program offers a series of Medicare 101 online classes and, after those fill up, a round-the-clock help and resources line.

But given the uncertainty created by the cancellation of some plans and the emergence of others, Alicia Lucke, the program’s manager, is urging people to act sooner than later.

“The sheer volume of calls we are getting really means people need to get going,” she said. “If I had one message for folks it’s don’t procrastinate. We’re on the edge of full right now and it’s only going to get busier in the weeks ahead.”

- Dana Tims is an Oregon freelance writer who contributes regularly to Lincoln Chronicle and can be reached at DanaTims24@gmail.com

Some tips to help get you started

By JIM SELLERS/The Salem Reporter

Insurance plans for 2026 were posted on the Medicare.gov website on Oct. 1. A prompt on the webpage will ask whether you are reviewing plans for 2025 or 2026 and then follow the prompts from there. Be sure you’re on the official Medicare.gov site and not on one trying to mimic the federal site.

- If you have Medicare supplement (Medigap) insurance, these open-enrollment dates don’t apply to you. Theoretically, you could change Medigap policies at any time. However, to do so without risk of incurring a higher premium because of a pre-existing health condition, beneficiaries are advised to use Oregon’s Medigap birthday rule.

- Volunteer SHIBA counselors are Medicare-trained volunteers in the federal-state Senior Health Insurance Benefits Assistance program. They provide free counseling – in the office, by phone or online via Zoom – about Medicare insurance and other Medicare topics. Call SHIBA at 800-722-4134 or at Shiba.oregon.gov.

- Insurance brokers who handle Medicare insurance: These are knowledgeable agents who can assist with the plans that they represent. Some are state-certified insurance brokers, who have passed a test of their Medicare knowledge and who have no substantiated complaints against them.

- Medicare offers a 24/7 phone helpline to assist beneficiaries: 800-MEDICARE (800-633-4227).

- The Oregon Department of Human Services staffs a SHIBA helpline at 800-722-4134; don’t enter your ZIP code, just stay on the line. Calls are answered during normal weekday business hours. If calls are backed up, your call may be routed to the national Medicare line (see above) with its “Welcome to Medicare” greeting.

— Jim Sellers of Salem is a certified Medicare counselor with the Senior Health Insurance Benefits Assistance program.

Some terms

- Medicare, created in 1965, is a national health insurance program for people 65 and older. It also includes a smaller number of younger people with certain disabilities. It consists of four parts — A,B,C,D. The first two are considered “Original Medicare” and include hospital insurance and medical insurance for doctors’ services, outpatient care and outpatient services. People can also purchase Part C, known as Medicare Advantage, as an all-in-one alternative to Original Medicare. These are sold by private insurance companies through contracts with the federal government. They typically include plans that offer prescription drug, dental, vision and additional coverages.

- Medigap (or supplemental) is private health insurance that helps cover some of the out-of-picket costs not covered by Original Medicare. Anyone enrolled in Medicare can buy Medigap, but it is considered most beneficial if purchased during the 6-month Medigap open enrollment period to avoid questions about a person’s health history. Plans can vary, but they must be standardized. Medigap is different from Medicare Advantage, which is a separate and alternative plan to Original Medicare.

— Source: Medicare.gov

I am an affected Samaritan Medicare Advantage member. I have done my homework and I am planning to return to original Medicare with a supplement (Medigap) plan and a drug plan. I still have questions and am getting conflicting answers from different sources. Here are my questions:

1. How do I switch back to original Medicare starting January 1, 2026?

2. How do I use my guaranteed issue right to get a supplement (Medigap) plan without medical underwriting?

3. If a provider accepts original Medicare, does the provider have to accept whichever supplement (Medigap) plan I choose?

4. Since all supplement (Medigap) Plan G plans have exactly the same coverage, is there any reason I should not choose the insurance carrier with the least expensive premium?

5. What exactly are the dates for the special enrollment period for the Samaritan Advantage members who have to change? I read on the Medicare.gov site that I “must apply for a Medigap policy: 60 days before the date your Medicare Advantage Plan coverage ends. No more than 63 days after your Medicare Advantage Plan coverage ends.”

Does this mean I have to apply exactly on the 60th day before January 1, 2026? Or just that that is the first day I can apply? Do I have to apply by December 7, 2025 or do I have longer? What date do I need to apply by to have the supplement plan take effect January 1, 2026?

6. A “Medicare Advisor” said in the situation of a Medicare Advantage plan ending that I must get the supplement plan first before applying for the drug plan. He said if I apply for the drug plan first it will cancel my current Samaritan Medicare Advantage plan. Is this true?

SHIBA has ls yet to schedule a call to discuss options. It took two weeks last month for someone to acknowledge my call.